Frequently Asked Questions

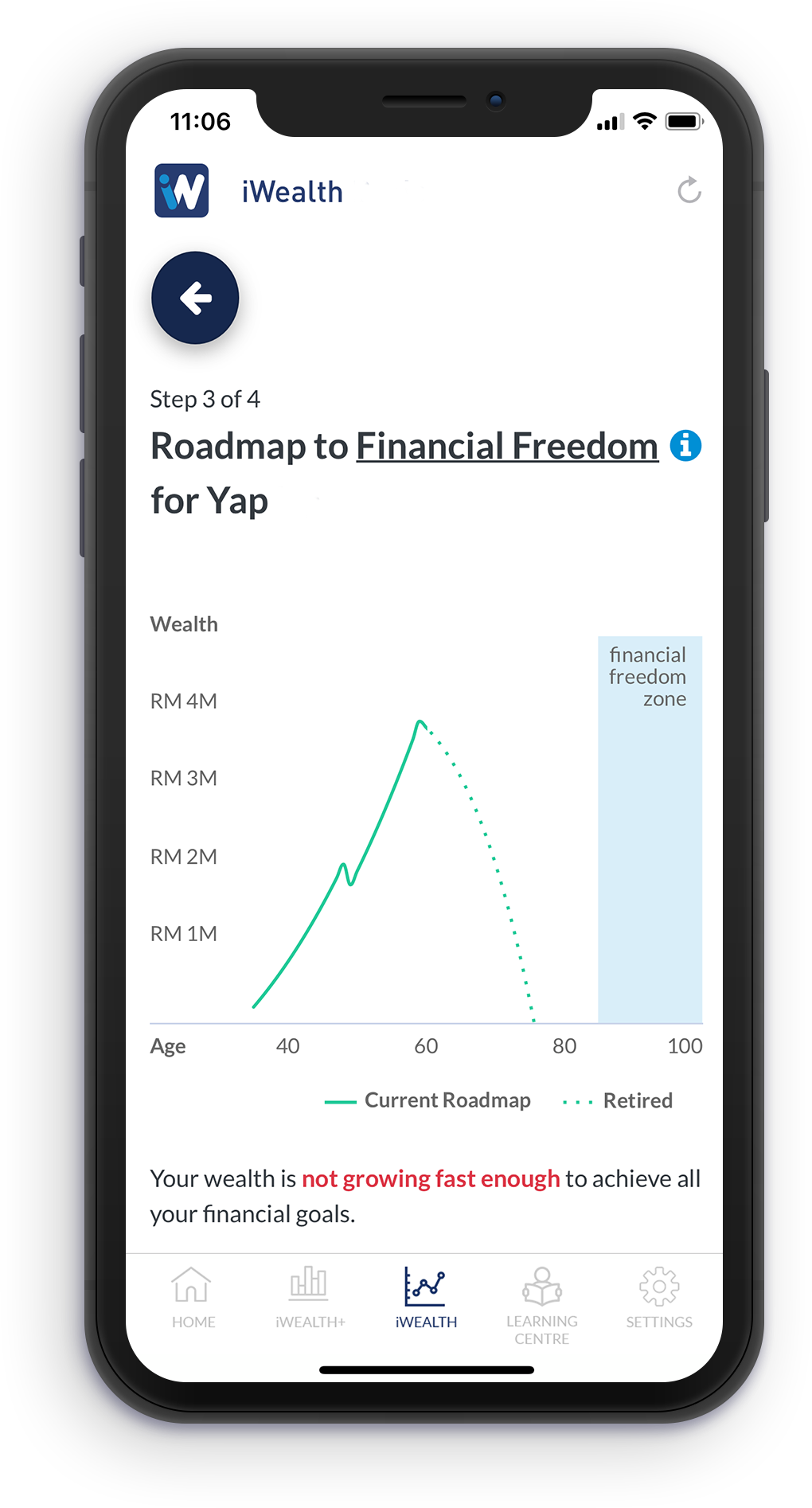

1. What is iWealth?

iWealth is a free tool that helps you to find out if your wealth is growing fast enough to achieve your financial freedom.This tool will help you to generate the Roadmap to Financial Freedom chart,that shows you where you currently stand in your financial position, and also will give some advice on how to improve and reach financial freedom. This tool is accessible via the mobile app, available for iOS and Android.

2. Who is suitable to use iWealth?

Anyone who is serious about managing their finances. Ideally, it is for those that have started working, and have some savings.

3. Is iWealth really free to use?

Yes, iWealth is free to use by everyone. Just download the app, and complete the simple registration in the app itself. No credit card payment will be taken.

4. Is my data secure?

At iWealth, it is our top priority to keep your personal data private and secure. Our systems are designed with multi layer security protections. Everything you enter into iWealth is transmitted with the same level of encryption used by banks and the military. Your encrypted data safely kept on servers in a heavily guarded data-center. Our internal processes ensures that access to your data is restricted to only our employees who need to see it. Further, our security experts are constantly on the lookout for potential flaws to ensure that there are no vulnerabilities and that no unauthorized access has taken place.

SOME OF THE SPECIFIC SECURITY MEASURES WE USE INCLUDE:

- SSL/TLS encryption of network communications between all of our servers

- Networking provided by an ISO 27001 certified cloud computing infrastructure

- Multi-Factor Authentication (MFA) mandated for our internal tools

- Constant software updates throughout our office and system infrastructure, to meet the latest security standard and requirements

- Compliant to Personal Data Protection Act, this means that your account and information is protected from 3rd parties

5. Troubleshooting on iWealth Registration

In case you don’t receive the verification email after completing the registration process in the iWealth mobile app, you may try the following suggestions:

- Check in your junk/SPAM mailbox whether it falls into thatfolder

- Request for the verification email again (you can access this when you press login, and key in your login credentials. The "Resend Verification Email" link should appear for you to press it)

- If you still have trouble getting the verification email, please contact us at hello@iwealth.com.my