We give you a clear picture of the things you need to do to achieve your financial freedom in 3 stages.

A big picture paints a thousand words. We help you paint your big financial picture by organising all your money matters in one place. We show you all your assets, liabilities, income, and expenses in a single view.

Using a picture, we show you where you are now in your journey to achieve financial freedom and how far are you from the destination. We highlight gaps and opportunities on how you can get more from your money.

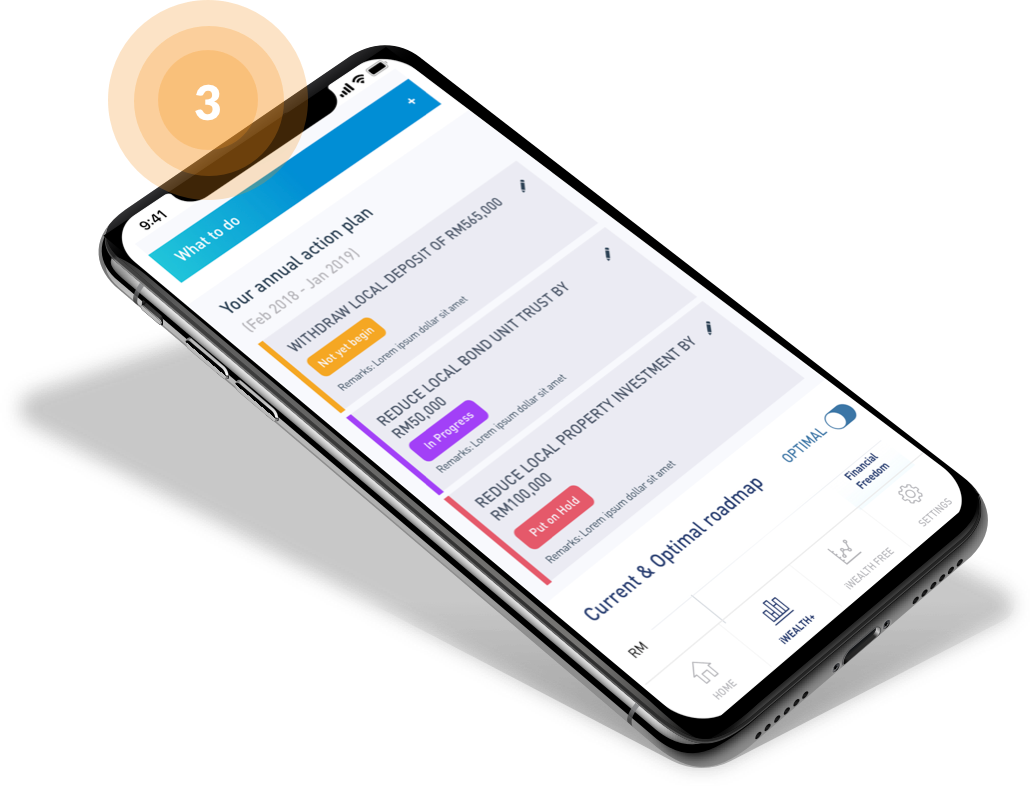

We help you improve your wealth by providing personalised recommendations and insights based on your financial profile. We work with you to build an annual action plan so that you can make sure that you are doing everything necessary to move to your financial freedom destination.

Our certified wealth manager will assist you to organise your financial information and set your financial goals.

We will aggregate and analyse all your financial information. We will benchmark your financial performance against the best practices developed from advising thousands of our advisory clients.

Our wealth manager will present your personalised roadmap to financial freedom to you. It will then be uploaded to your mobile app for your access 24/7.

We just need you to fill in some of the details below, in order for us to assign a Qualified Wealth Manager to contact you. And don't worry, this chat session is free for you.

Terms and Conditions / Privacy Policy:

- Please note that all information collected is for internal use to assign the suitable wealth manager to serve you. The information key in above will not be shared to any third party. To read the full Privacy Policy, you may refer here.

- If you prefer to speak to our customer service agent on providing the above information over phone, please call our hotline at +6 03 7880 8359.

- Upon receiving your answers, our Wealth Manager will contact you within 48 business working hours.

* Annual Household Income include the active and passive income from both yourself and your spouse.

** Total Gross Asset include investments, properties, home, cash, shares, direct bonds, unit trust funds, Amanah Saham funds, EPF, CPF, PRS, Tabung Haji and others.

Apart from the free tool from iWealth, we offered a premium (and paid) service called the iWealth+. It is a professional step by step guide to achieve financial freedom, which you can access all of the information from the mobile app. For those who wants to have a holistic wealth management strategies developed by a professional wealth manager.

At iWealth, it is our top priority to keep your personal data private and secure. Our systems are designed with multilayer security protections. Everything you enter into iWealth is transmitted with the same level of encryption used by banks and the military. Your encrypted data safely kept on servers in a heavily guarded data-center. Our internal processes ensures that access to your data is restricted to only our employees who need to see it. Further, our security experts are constantly on the lookout for potential flaws to ensure that there are no vulnerabilities and that no unauthorized access has taken place.

SOME OF THE SPECIFIC SECURITY MEASURES WE USE INCLUDE:

In case you don’t receive the verification email after completing the registration process in the iWealth mobile app, you may try the following suggestions:

If you still have trouble getting the verification email, please contact us at hello@iwealth.com.my